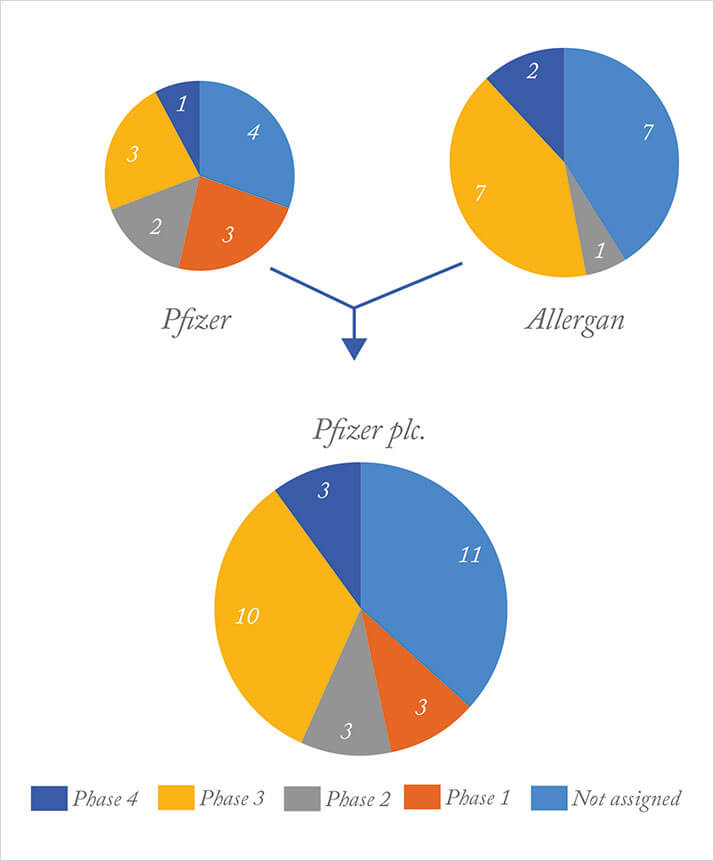

Pharmaceutical giants Pfizer and Allergan recently announced that they intend to merge (1) – or rather, Allergan is to perform a “reverse takeover” of Pfizer – and it’s one that would form the world’s largest pharmaceutical company. Both Pfizer and Allergan have eyecare portfolios, although Allergan’s is clearly more extensive than Pfizer’s – and both have ophthalmic products in their pipelines. According to clinicaltrials.gov, Pfizer and Allergan have 13 and 17 trials currently underway, respectively (see Figure 1), so it’s clearly a big deal for ophthalmology. But the reverse takeover has prompted a significant amount of controversy. Media coverage has focused heavily on the tax implications. Although Pfizer, headquartered in the United States, was effectively taxed at 25.5 percent in the previous January–December fiscal year, a “takeover” by the smaller, Republic of Ireland-based Allergan could bring that rate to 18 percent. The move – termed “tax inversion” – can deliver Pfizer’s shareholders significant value (albeit at the expense of the US federal government’s tax receipts). This is not Pfizer’s first attempt to acquire a European company for what appeared to be tax inversion purposes; nearly two years ago (and after considerable media and US governmental hostility), UK-based AstraZeneca plc’s board of directors rejected Pfizer’s advances towards them (3).

If the transaction does go ahead, the company – to be renamed Pfizer plc – is expected to maintain Allergan’s legal domicile in Ireland, but maintain Pfizer’s New York operating headquarters and trade on the New York Stock Exchange. Pfizer’s chief executive officer Ian Read said that the merger would place the company “on a more competitive footing” with its non-US-based rivals (1).

References

- R Pierson, B Berkrot, “Pfizer to buy Allergan in $160 billion deal”, (2015). Available at: http://reut.rs/1jhNGbE. Accessed November 24, 2015. R Rubin, J Heller, “Pfizer CEO says U.S. tax regime pushing him to seek alternative”, (2015). Available at: http://on.wsj.com/1MlaMWg. Accessed November 24, 2015. Pfizer Inc., “Announcement regarding AstraZeneca plc”, (2014). Available at: http://on.pfizer.com/1N5LaNw. Accessed November 24, 2015.