The Business of Innovation

Ahead of the Ophthalmology Innovation Summit 2019 at AAO, we reach out to a panel of experts to uncover market trends – as well as the latest advances shaping the field

By bringing together clinical, capital and corporate leaders – all key stakeholders in the development and commercialization of novel technologies and therapies – the Ophthalmology Innovation Summit (OIS) has a clear objective: to act as an innovation accelerant, helping convert conceptual sparks into glowing success.

The brainchild of ophthalmologist and venture capitalist Emmett Cunningham (Blackstone Life Sciences) and experienced conference producer Craig Simak, OIS fully sprang into life when two fellow venture capitalists – William Link of Versant Ventures/Flying L Partners and ophthalmologist Gil Kliman of InterWest Partners – came on board to co-chair the initial programs. OIS had found a recipe for success.

The flagship “OIS@AAO” began in 2009 and – a decade on – will attract 1,200 leaders in ophthalmology with the common goal of addressing unmet vision needs. For 2019, the full-day (6:45 am–6:30 pm) program on October 10 covers everything from the game-changing technologies of today and tomorrow, to opportunities and challenges for healthcare leaders, to markets updates – not to mention a “Keynote Conversation” between Alex Gorsky, Chairman & CEO of Johnson & Johnson, and summit co-chair Link.

Here, we ask seasoned OIS experts to get us up to speed for OIS@AAO with notable approvals, business trends, and a glimpse of how the innovators of the future are being forged.

FDA CDER Update: The Latest Approvals

By Gary Novack, PharmaLogic Development

Over the last six months, only four products were approved (see Table 1). And though none were new chemical entities in the USA, they do represent new therapeutic options for American patients and eye care specialists. There are relatively few fixed-dose combinations available in the USA to lower intraocular pressure, and thus the Rocklatan approval represents a regulatory milestone.

Table 1. Original NDA/BLA approvals, listed in order of approval from February 1, 2019 through August 31, 2019. Center for Drug Evaluation and Research, Office of New Drugs, Division of Transplant and Ophthalmic Products.

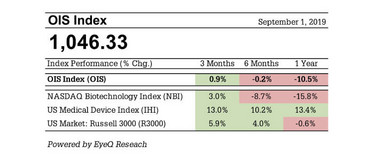

OIS Index Update

By Michael Lachman, EyeQ Research

The OIS Index of ophthalmic stocks turned in a flat performance over the six months between March 1 and September 1, 2019, outperforming the NASDAQ Biotechnology Index (-8.7 percent) but lagging an index of medical device stocks (+10.2 percent) and the overall US stock market (+4.0 percent).

Despite the flat six-month performance overall, declining stocks in the OIS Index outnumbered advancing stocks by a 2-to-1 margin. It was a particularly challenging period for small cap ophthalmic stocks. Among the 19 companies in the index with market capitalizations below $300 million as of July 1, 14 stocks declined by 20 percent or more, including nine stocks that declined by at least 40 percent.

Figure 1. OIS Index Performance Table.

Figure 2. OIS Index: Six-month performance.

OIS six-month market movers

Opthea +356 percent on positive clinical data from the company’s Phase 2b wet AMD trial

Adverum Biotechnologies +155 percent on progress in the company’s Phase 1 wet AMD gene therapy trial

Avedro +95 percent on positive operating results and an announced acquisition by Glaukos

Apellis Pharmaceuticals +92 percent on progress in Phase 3 geographic atrophy trials and in non-ophthalmic programs

Carl Zeiss Meditec +41 percent on strong financial reports and raised revenue and earnings expectations

Aerie Pharmaceuticals -54 percent following the stock’s strong run-up in advance of Rocklatan FDA approval

Public Markets Update

By Udit Patel, Piper Jaffray

Life science overview

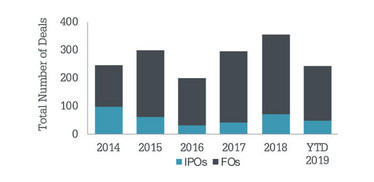

• The year 2019 is on pace for a record number of financings, with 48 initial public offerings (IPO) and 196 follow-ons (FO) completed to date raising a total of $28B (see Figure 3).

• IPOs have performed well, up 17 percent on average.

• Around $300M in equity raised for ophthalmology companies in 2019 YTD, across 1 IPO and 4 FOs.

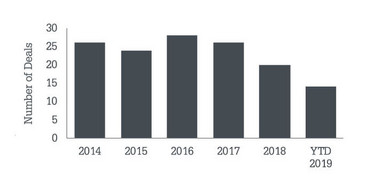

• Acquirers continue to favor commercial stage targets, which account for 10 out of the 14 public acquisitions in 2019 (see Figure 4).

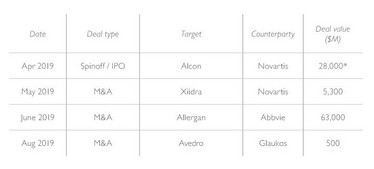

• Ophthalmology’s landscape continues to shift with Shire/Takeda exiting the space, the Alcon spin out, and now the acquisition of Allergan (see Table 2).

Figure 3. Life science equity financings.

Figure 4. Public company life science M&A.

Table 2. Recent ophthalmology transactions.

*Market capitalization as of 4/9/2019 (the first day of trading following their spinout of Novartis) Source: Piper Jaffray Equity Capital Markets, Company Filings, FactSet. Data as of 9/10/2019.

FDA CDRH Update

The Ophthalmology Innovation Fellowship: How Stanford University and CDRH are partnering to deliver the next wave of innovators

Lee Kramm (ClinReg Consulting Services) interviews 2018-2019 fellow Frank Brodie, Vitreoretinal Fellow, Department of Ophthalmology, Duke University

What led you to apply for Stanford Ophthalmology Innovation Fellowship?

Something that I enjoyed during my residency at UCSF was trying to find solutions for problems I encountered in clinic. I developed a wearable position tracker and alarm for patients who had to position after retinal surgery, a method for developing custom glasses for children with craniosynostosis, and an approach to stimulate the retina through a congenital cataract in hopes of forestalling amblyopia. The Stanford Ophthalmology department has an impressive reputation for devising and developing new technologies and bringing them all the way to clinical care. Mark Blumenkranz personally has an incredible track record in this respect. I had gotten to meet him a few times and, in addition to being a fantastic clinical teacher, he’s known for being a terrific mentor, so this was a significant draw. Additionally, being part of the Stanford community was an exciting prospect as innovation seems to be in the DNA across the campus and the program allows for the flexibility to engage in outside classes and research. Finally – and very importantly – the program offers the unique opportunity to work with the FDA on a variety of projects and provides an indepth education on the regulatory process.

Which subjects are covered by the fellowship?

The fellowship focuses on how to take an idea, develop and test prototypes, assess commercial viability, and understand and plan the regulatory pathway. You meet regularly with David Myung and Blumenkranz, who provide insight and mentorship. Additionally, they each have deep and broad connections in the scientific and medical device communities, so you can meet, get advice from, and collaborate with leaders in the field throughout the year. In addition to this central project, the fellow spends considerable time at the FDA, in my case, a week in the fall, a few days in the early spring and then again at the end of the academic year. While at the FDA, you both learn general concepts of regulatory science for ophthalmic devices as well as those specific to your fellowship project. In addition, I was fortunate to be able to participate in the planning of the FDA spring workshop “Forum on Laser Based Imaging.” Finally, I took the graduate level Biodesign capstone course in which we worked in teams to develop novel technologies; we had speakers across diverse backgrounds addressing topics, such as raising capital, IP strategy and clinical trials design. Overall, it was an unbelievable year that touched on nearly every aspect of medical innovation and product development in ophthalmology.

What key concepts did you take away from the fellowship regarding premarket/postmarket regulatory science while at the CDRH with Malvina Eydelman and her staff?

As clinicians, we always consider the risk benefit ratio in terms of a single patient and treatment; however, I found this concept needed to be adapted to the clinical development and regulatory process as well. And that requires a determination of what features of a device pose the greatest potential risk and how we can ensure those who might be the first humans to use it potentially stand to benefit the most.

I also gained an appreciation for how clarity and specificity on the label for a device are paramount. It is the lens through which an entire FDA submission is viewed, so clearly defining the population and for what condition the device is intended is critical in developing a regulatory plan.

What did you find most surprising about FDA’s regulation of medical devices?

I was impressed and grateful, as a user of these devices, for the incredible rigor of preclinical testing that devices undergo prior to first in-human trials. Though many of these tests are standardized for certain devices, such as IOLs, I also admired the flexibility to adapt tests and development of new ones to fit specific product attributes that might be novel.

What positives (or negatives) did you observe?

I was incredibly impressed by the team at the FDA. They were not only deeply knowledgeable within their fields, but eager to find and support products that could help patients. They were motivated to work with applicants in developing a path forward for their products. Additionally, because they have seen such a huge number of products and clinical data, though they cannot specifically reference specific files in leveraging historical experience, any advice they give comes from it.

In clinical practice, we use a variety of products off-label – not in the manner they were approved by the FDA. For example, almost none of the current IOLs are approved for sulcus placement, yet threepiece lenses are routinely placed in the sulcus without complication. Unfortunately, this makes the development of products based on sulcus placement difficult to evaluate as the IOL would first need to be approved for sulcus use. The FDA is increasingly open to using real-world data; one example being the IRIS Registry by American Academy of Ophthalmology, as supporting data in regulatory evaluation, so it will be interesting to see how this comes to play with off-label use of devices.

What can the industry do better to facilitate the FDA’s work?

I spent a lot of time learning about the various new programs the FDA is developing to support device innovation and expedite approvals for products. These include the Breakthrough Pathway, Early Feasibility Studies, and Humanitarian Device applications. I think these all offer tremendous opportunities for companies to engage the FDA in the development of truly novel products and advance meaningful innovation.

The pre-submission process allows any applicant to have discussions with the FDA on a broad range of topics prior to a formal submission. This incredibly valuable opportunity allows companies to understand and respond to regulatory concerns before going too far down the development and clinical trials pathway.

OIS@AAO takes place Thursday, October 10, 2019 at the Hilton San Francisco Union Square. For more information and to register, please visit ois.net/ois-aao-2019